This is the second Annual Survey of Mobility as a Service published by Landor LINKS, in which we look at developments in this quickly evolving field since the launch of the publication in 2017.

The intention of this series is to assess both the emergent concept of MaaS, and how it is being understood, pursued and responded to by different parties, and to record the development of individual elements of MaaS-type schemes and systems that promote and facilitate multi-modal, user-centric and flexible choices and purchases of travel facilities by consumers.

The implicit question we seek to address for all those with an interest in the sector is whether, and if so when, there will be a major reshaping of the travel and mobility marketplace in which the consumer’s perspective will change fundamentally from the current mode-by-mode ‘search and book’ model, to a solution-based marketplace addressing individuals’ overall mobility needs.

Advocates believe this will be intrinsically beneficial and arguably inevitable, in the modern digitally-driven world.

Travel in the UK is a large – but not rapidly expanding – market. Individuals have reduced the amount they travel and the ways in which they organise and pay for them have changed.

New mobility modes and services have emerged – and whilst they currently account for a small percentage of the annual market, their ability to grow rapidly – particularly with the generations born after 1980 - enables this sector to have a much greater impact in the future, allowing disruptive companies to enter the market and attract new revenue streams.

At the same time, this generation are the first ‘digital native’ cohort – who have not known a life without internet and expect to be able to manage all aspects of their lives digitally (usually through smartphone apps) as a matter of course. This expectation extends to transport, where opaque fare structures, cash payments and the absence of real time journey information appears anachronistic.

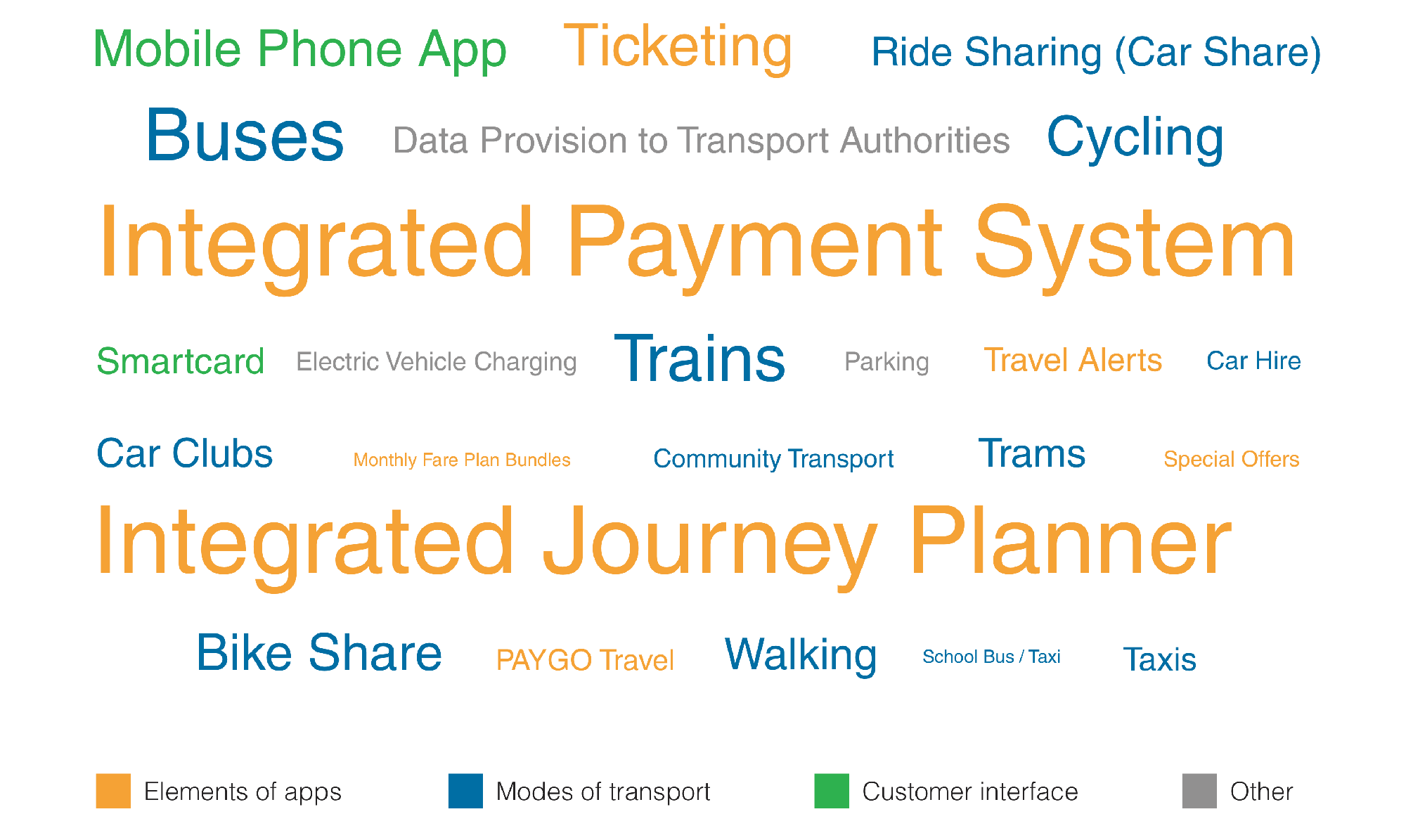

Mobility as a Service is an emerging term with multiple definitions which largely fall within a catch-all set of new digital, demand-driven, transport, innovative services and multi-modal integrations. Examples which fall into this set include smart transport solutions aimed at driving down car use, innovative (and simplified) transport purchasing models, new services that are multi-modal at their outset and those which start with a single mode and add additional modes to their offer.

At the same time automotive industry is responding to trends towards ‘usership’ rather than ‘ownership’ by investing in novel technology and new business models. Public transport operators, meanwhile, are struggling to reinvent their offering in this arena. They are experiencing fault lines in their business models and deteriorating financial performance. There are threats from disruptive new entrants from technology and transport – from Apple to Uber – along with parallel disruption in the banking and online consumer/transactions sectors.

Whilst the nature of disruptors is to adopt a ‘move fast and break things’ approach it is not possible for incumbent operators – often dependent on subsidies and with services defined by franchises and operating licences – to respond in kind.

The emergent successful services will be shaped by a number of factors – including investment in and development of disrupter technologies; how these relate to existing transport, automotive and technology industries and how they relate to regulatory frameworks as these evolve.

Survey participants view Mobility as a Service as something that will change transport for the better. They anticipate that it will provide people with integrated journey planning and ticketing – primarily combining public transport, walking, cycling and taxis. They expect this vision of Mobility as a Service to have positive impacts on congestion and air quality.

The potential prize for such a system is enormous. The acid test however will be in the perceived and demonstrable benefits to the consumer, and by association the strength of political support that is expressed. The public sector has an essential role in providing a framework which facilitates and manages the activities of all the different players. The enthusiasm is there, significant fragments are emerging but the challenge is creating a generally recognised and functional landscape into which everything fits. This publication provides an essential progress report.

Peter Stonham, Editorial Director, LTT and Landor LINKS

However, this year the survey threw into sharp relief the difference in attitudes between transport authorities (and those that work with them) and transport providers. The most significant is that the transport planners expect public transport to form the core of Mobility as a Service, but public transport operators are not fully convinced of the business case, and are concerned about costs.

Survey respondents from all groups expressed a desire for policy and regulation at national and local level to shape the mobility services provided. This includes specific comments about sharing data, ensuring that pricing works to facilitate joined up journeys and that ticketing works on mobile.

There was strong consensus that all modes should be required to share their data – including autonomous shared vehicles, bike share and on demand shared transport.

It is clear that whilst transport planners see the potential for Mobility as a Service to improve transport, the concept is still being drawn in different directions by commercial realities.

The evidence from case studies and market research is that those operators providing data which integrates their journey planning, booking and ticketing into broader linked systems will grow their markets, rather than putting their existing revenues at risk. The uptake of services which are easy to access, generally responds well to the improved offer, and increasingly expects the flexible and customer-centric approaches to transport provision, that is familiar to them in other sectors.

Current regulations are lagging behind the innovation within the sector – with no regulatory parity between services which are increasingly converging (in the eyes and experience of the consumer) as lines blur between buses, minibuses, taxis and indeed cars.

The plethora of legislative frameworks based on vehicle type rather than function is not likely to play out well. Whilst the Bus Services Bill is a step forward in some respects, this convergence means the legislation could be out of date before it is even delivered. With this in mind, any future legislation needs to be considered carefully to ensure regulatory parity for new and legacy services whilst allowing innovation in the field.

However, the announcement of the government’s Future of Mobility Grand Challenge, and the findings of the Transport Committee’s Inquiry into MaaS have opened up opportunities for national discussion of the area.

The overwhelming message is that Mobility as a Service needs vision – from government, operators and others delivering transport systems.

Whilst evidence of the potential for Mobility as a Service emerges, its development will be shaped by policy and regulatory frameworks as well as commercial service development.

With moves within government to recognise the challenges that transport innovation brings, there is now a national arena to develop a vision and framework for Mobility as a Service.

This is the second Annual Survey of Mobility as a Service published by Landor LINKS, in which we look at developments in this quickly evolving field since the launch of the publication in 2017.

The intention of this series is to assess both the emergent concept of MaaS, and how it is being understood, pursued and responded to by different parties, and to record the development of individual elements of MaaS-type schemes and systems that promote and facilitate multi-modal, user-centric and flexible choices and purchases of travel facilities by consumers.

The implicit question we seek to address for all those with an interest in the sector is whether, and if so when, there will be a major reshaping of the travel and mobility marketplace in which the consumer’s perspective will change fundamentally from the current mode-by-mode ‘search and book’ model, to a solution-based marketplace addressing individuals’ overall mobility needs.

Advocates believe this will be intrinsically beneficial and arguably inevitable, in the modern digitally-driven world.

Over the last year the profile of Mobility as a Service as a concept in the UK has undoubtedly been raised further in both professional and media circles.

Significantly, the Transport Committee of the UK Parliament launched a public inquiry into Mobility as a Service, in November 2017 and has heard evidence from a wide range of organisations and individuals with interest in the field. Its conclusions are expected later this year. Perhaps even more importantly, the Government included the Future of Mobility in its core group of four ‘Grand Challenges’ established in the industrial strategy to improve people’s lives, increase the country’s productivity and put the UK at the forefront of the industries of the future. It believes achieving its ambitions in this field will help meet the needs of an ageing society, capitalise on strengths in artificial intelligence and data, and support clean growth.

In its Future Mobility call for evidence, the government identified shared mobility developments, data connectivity, changing consumer attitudes and new business models (including MaaS) as key trends and a new regulatory framework as an important element to allow positive change as the route towards “easy payment mechanising, real-time information and a more responsible and seamless public transport service” that “could reduce car ownership or move people towards public transport”.

On the ground in the major metropolitan areas of England, there have been a number of steps by the transport authorities to further embrace and encourage MaaS concepts.

Notably, the launch of Whim in the West Midlands, marked the first MaaS platform to integrate a broad range of modes and made headlines with its micro house installed on a parking space to provide a strong visual for the possibilities that reducing car dependence allows.

In London, where there has arguably been the most established movement towards genuinely integrated presentation and facilitation of a total transport system to users over recent years, there continues to be an interesting discussion on what the next steps towards a broader MaaS offer should be. More unconventional forms of shared transport continue to become available, yet sit outside the established TfL regulatory framework and single Oyster contactless-based payment system.

There has been strong interest in Scotland in a national level policy framework for Mobility as a Service with government and industry support for MaaS Scotland. Effectively Scotland has some of the most advanced test beds for MaaS in the world and this year the case studies in our MaaS survey reflect that.

Whilst there are some interesting individual developments in Wales with innovators such as the Riversimple Rasa – a subscription-based hydrogen fuelled car, ticketing for Arriva Trains Wales and the successful launch of Nextbike in Cardiff, there is not yet a systemic approach to MaaS as a sector.

TfL’s suspension of Uber’s licence and subsequent granting of a probationary 15 month licence on appeal has been probably the highest profile story about any new mobility platform. Decisions on the authorisation and regulation of similar schemes, including the wave of new, dockless, bike share schemes and novel competitors to Uber like ViaVan and Ford Chariot have also had their fair share of media coverage around the country. As have innovative demand-responsive and taxibus public transport schemes like Arriva’s Click project, launched in Sittingbourne and now being extended to Merseyside.

The Survey this year concentrates more on developments in projects and real world impacts than on ideas, expectations and opinions. Emerging themes are much stronger as activity in the field has developed – and this year the narrative is focused on drawing together these themes rather than anthologising a number of individual voices with divergent views on the topic.

This does not mean that there are not differences in perceptions and expectations. They are, however, solidifying around real world examples, outturns, issues and challenges rather than dealing with the more conceptual approaches and aspirational thinking about a coming new world of integrated mobility which were more relevant last year.

There remains optimism about MaaS, and a belief it should consist of integrated journey planning and payment and that, like last year, the most important modes are public transport, cycling and walking. There is more emphasis this year on taxis. We have also taken the opportunity to ask additional questions about open data and visions of MaaS.

The Survey is conducted within a broader context of developments within the transport and travel sector, and in society more generally. There is growing evidence (like the work of the Commission on Travel Demand) that future travellers will be less car-oriented, more mode neutral and open to fusing their travel activity. They are likely to be happy to game their options but in general be intolerant of multiple interfaces and transactions, preferring to make buying decisions through a single intermediary relationship. That latter expectation could perhaps be the crucial prompt to the true arrival of MaaS and commercially reward any determined enterprise which becomes the consumer’s access point of choice to the personal travel marketplace.

In this context automotive industry investment in novel technology and new business models moving away from the vehicle ‘build and sell’ tradition is at an all time high. A considerable range of initiatives by both the major motor manufacturers themselves and associate enterprises is exploring the MaaS commercial space.

Whilst public transport might be seen to be well-placed to move into the same business space, they have appeared more concerned with managing financial pressures within their existing portfolios. Their struggles in this regard may lead to major rethinks of their approach and the opportunities offered by technology and potential new business opportunities, or maybe them falling prey to changes of ownership by those better equipped to make such a transition.

There are potentially greater challenges to their existing business by disruptive new entrants from outside the sector, and with a range of backgrounds in the digital eco-system. The names are now familiar: Google, Amazon, Apple, Uber et al. Not to mention disruptors in the financial services, payments and online consumer/transactions sectors who are eyeing up the volume activity that mobility services can offer them.

In some respects all this is unsurprising. We live in a time of unprecedented change in the expectations and behaviours of individuals in society, and in the disruptive influences brought to bear in the worlds of business and other fields of economic and social life. Against this scenario, the regulatory framework in which these matters are playing out seems fragmented and ill adapted to responding to the authorisation of new services and appropriate consumer protection. Indeed, those intent on disrupting the current transport landscape tend to pay little regard to conventional rules, until challenged, whilst the established players face the danger of seemingly defending the status quo, in which they have an obvious self-interest, against those with tempting new propositions.

In this situation, Government and public authorities often seem well behind the game and their interventions are built on partial perceptions of both what is happening and what is needed from them, with dangers of mistakes and the wasteful application of resources to create frameworks and systems that may be out of date before they are even delivered.

However, whilst there is a desperate need to create an open market with better regulatory parity and a level playing field for both new and legacy operators, gaps to fill in what the market wants to provide may still require intervention to meet public interest objectives and the needs of those left unserved, and to co-ordinate the way different elements of the overall transport offer are integrated.

Whilst it’s clear that social attitudes, the impacts of new technology and the most appropriate business models to take things forward, are all in flux, the actual future interaction between these elements of the transport universe and their implications is still opaque.

The astronomers look on, but who yet can really predict where it is all going to end? Will there potentially be a MaaS ‘big bang’ sometime soon?

We look forward to continuing to monitor activity in this space and to reporting on our further observations next year. There is unlikely to be a shortage of developments to record, and quite possibly some further major new market and policy interventions that further re-define the discussion, and the potential shape of the new mobility eco-system.

Beate Kubitz is a writer and thought leader on the emerging mobility agenda. After working in shared transport she joined the board of TravelSpirit, and is a consultant for a number of organisations.

Peter Stonham holds a degree in transport and has studied and written about the subject for more than 30 years. He is editorial director of Landor LINKS, which he founded, and has led the development of Local Transport Today and its other specialist magazines and online networks.

SHARE THIS PAGE!